2018 Tax Reform Update | Congress Passes Tax Cuts and Jobs Act

01/04/18

On December 22, 2017, President Donald Trump signed the Tax Cuts and Jobs Act, the largest overhaul of the Internal Revenue Code since 1986.

The Act makes sweeping changes to individual, business, international, and estate taxing regimes. This 2018 Tax Reform Update highlights some of the most significant changes contained in the legislation. As always, please contact any member of Bodman’s Tax Practice Group for more information or to discuss how the Act will affect your business or personal tax obligations.

Corporate and Business Taxation

Corporate Tax Rate: Beginning in 2018, corporations pay a flat income tax rate of 21%.

Corporate Alternative Minimum Tax: The corporate alternative minimum tax is repealed.

Temporary Full Expensing for Business Assets: Taxpayers can fully expense business property placed in service after September 27, 2017 and before January 1, 2023. Taxpayers can fully expense new or used property.

Limitation on Business Interest Expense Deduction: Generally, the business deduction for interest expense is limited to the taxpayer’s business interest income for the year plus 30% of adjusted taxable income plus floor plan financing interest. Any interest that isn’t deductible can be carried forward indefinitely. The limitations don’t apply to businesses whose annual gross receipts for the prior three years don’t exceed $25 million.

Deduction for Domestic Production Activities: Taxpayers can no longer claim a deduction for income attributable to domestic production activities (e.g., manufacturing, construction, etc.)

Net Operating Losses: NOL deductions will be limited to 80% of taxable income. NOLs can no longer be carried back two years; instead the NOL will carryforward indefinitely.

Like Kind Exchanges: Nonrecognition for like kind exchanges will be limited only to real estate that is not held primarily for sale.

Entertainment Expenses: Taxpayers may not deduct entertainment, amusement or recreation expenses even if the expenses are related to the taxpayer’s trade or business.

Deduction for Providing Qualified Transportation Fringe Benefits: Employers may no longer deduct the cost of providing qualified transportation fringe benefits to its employees (e.g., transit passes, parking, etc.). Employees can still exclude these amounts from their gross income.

Self-Created Intangibles: Gain or loss from the sale or disposition of patents, inventions, models or designs or secret formula or process will be treated as ordinary and not capital.

Research and Development Credit: The R&D credit remains.

Orphan Drug Credit: The credit is limited to 25% of qualified clinical testing expenses.

Settlements of Sexual Harassment and Sexual Abuse Claims: The new law disallows a deduction for any settlement, payout or attorney fees related to sexual harassment claims or sexual abuse claims if the payments are subject to a nondisclosure agreement.

Employer Credit for Paid Family and Medical Leave: Taxpayers that offer all full time employees at least two weeks annual paid family and medical leave can claim a credit for a percentage of wages paid to an employee during the time the employee takes the leave.

Aircraft Management Services: Amounts paid by an aircraft owner for management services related to maintenance and support of the owner’s aircraft or flights on the aircraft are exempt from excise taxes.

Passthrough Entities

Qualified Business Income Deduction: Generally, taxpayers that operate a business through a partnership, S corporation or sole proprietorship can deduct 20% of “qualified business income.” Qualified business income is generally all domestic business income other than investment income (e.g., dividends, capital gains, etc.). For some taxpayers, this deduction is limited to the greater of 50% of the W-2 wages paid in connection with the business or the sum of 25% of the W-2 wages paid in connection with the business plus 2.5% of the unadjusted basis of qualified property.

International

Foreign-Source Portion Dividends: A domestic corporation may deduct 100% of the foreign source portion of dividends received from certain foreign corporations.

Repatriation Tax: The new law imposes a mandatory tax on accumulated and undistributed foreign earnings. The rate is 15.5% on earnings held in cash or cash equivalents and 8% for earnings held in illiquid assets. Taxpayers can elect to pay this tax over an eight year period.

Individual

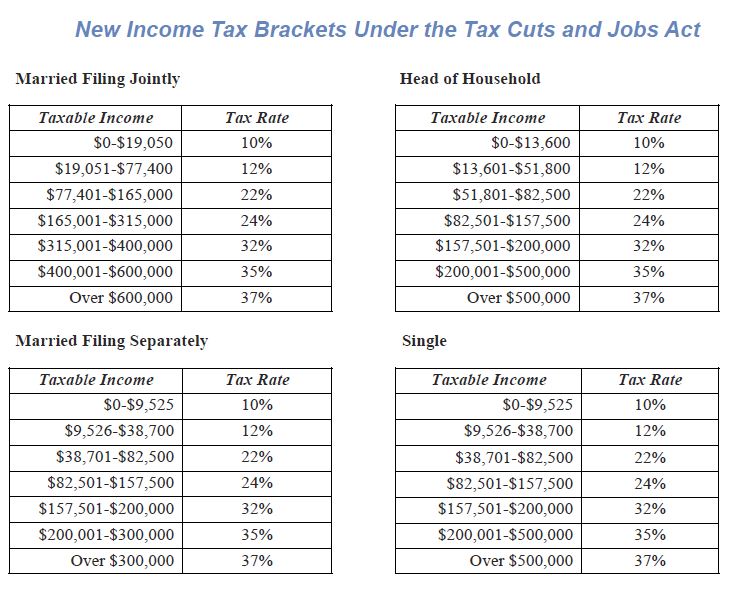

Tax Rates: The Act modifies the existing seven tax brackets and caps the highest tax bracket at 37%. Please refer to the tables on page 4 for a detailed summary of the new tax brackets.

Standard Deduction: The law increases the standard deduction to the following amounts: (a) $24,000 for joint returns; (b) $18,000 for head of household; and (c) $12,000 for single filers.

Personal Exemptions: Personal exemptions are eliminated.

Miscellaneous Itemized Deductions Subject to 2% Floor: The law eliminates itemized deductions for unreimbursed employee expenses and tax preparation fees.

Mortgage Interest Deduction: The deduction for mortgage interest is reduced to interest incurred on $750,000 of acquisition indebtedness for mortgages created after December 15, 2017. The law also suspends the mortgage interest deduction for interest on home equity loans for years 2018 through 2025.

State and Local Tax Deduction: Individuals can deduct state and local property and sales taxes that are related to the individual’s trade or business. Taxpayers may elect to deduct sales, income or property taxes up to $10,000 (if the taxpayer does not take the standard deduction).

Charitable Contribution Deduction: The limitation on cash contributions is increased from 50% to 60% of a taxpayer’s adjusted gross income (if the taxpayer does not take the standard deduction).

Personal Casualty Losses: Taxpayers can claim a personal casualty loss for personal property only if the taxpayer suffers the loss as a result of a federally-declared disaster.

Medical Expense Deduction: Taxpayers can deduct medical expenses to the extent the expenses exceed 7.5% of the taxpayer’s adjusted gross income (if the taxpayer does not take the standard deduction).

Alimony Payments: A taxpayer making alimony payments may not take an above the line deduction for the payments and the recipient will no longer be required to include the payments as taxable income. This provision applies to divorce decrees and separation agreements entered into after 2018.

Moving Expenses and Reimbursements: Only active duty members of the Armed Forces who move pursuant to military orders may deduct moving expenses. Additionally, taxpayers must include moving expense reimbursements as taxable income.

Child Tax Credit and New Family Tax Credit: The child tax credit is increased to $2,000. Additionally, a taxpayer can claim a $500 credit for dependents other than qualifying children. The credit would begin to phase out for taxpayers with adjusted gross income exceeding $400,000 (for married filing jointly) and $200,000 (for all other taxpayers).

ACA Individual Mandate: Beginning in 2019, the penalty for not having health insurance during the tax year is reduced to zero.

Qualified Equity Grants: Employees that are granted stock options or restricted stock units can elect to defer recognition of gain for up to five years.

Estate and Gift Taxes

Estate and Gift Tax Exemption: The unified credit for estate and gift taxes is increased to $10 million, adjusted annually for inflation. In 2018, the exemption is $11.2 million.

Generation Skipping Transfer Tax Exemption: The GST exemption amount is increased to $10 million, adjusted annually for inflation. In 2018, the exemption is $11.2 million.

Tax Exempt Organizations

Excise Tax on Executive Compensation: The new law imposes a 21% excise tax on compensation in excess of $1 million paid to a tax exempt organization’s five highest paid employees during the year. The excise tax also applies to certain parachute payments.